If you want to choose the key words of the industrial Internet in the past three years, “disassemble and bind” counts as one.

Splitting industrial Internet business and promoting its independent listing has become a new trend for large industrial enterprises.

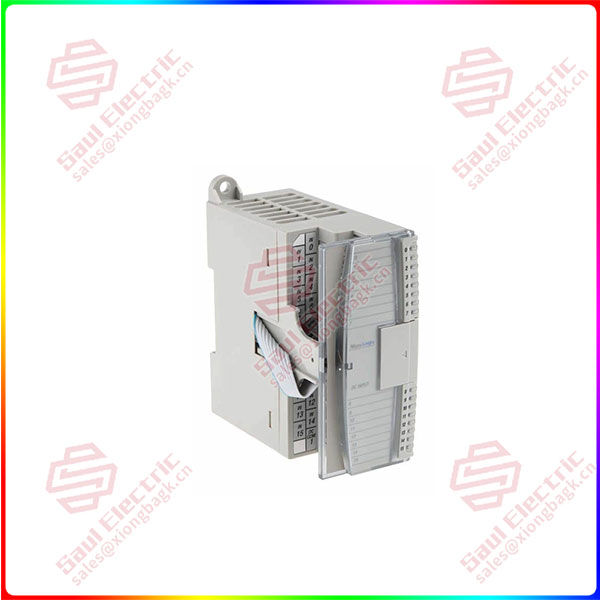

1762-IQ16 In recent years, Kaos and US Cloud Intelligence have independent listing plans, and Xugong Han Cloud is currently in the listing counseling period. Some enterprises have been split more thoroughly, root interconnection, industrial rich union, Lanzhuo have been independent.

From the mother, the story of industrial Internet companies splitting up and going public may not be as simple as the surface.

Side A: Helplessness and grievance

The A side of the crux of the split can be roughly summarized as: shareholders do not like it, the group is not willing to eat the new business.

Take a brief look at the situation of industrial Internet companies under large manufacturing groups.

The threshold is high, the profit is far.

Industrial Internet enterprises with platform as the core, especially dual 1762-IQ16 cross-platform, have high technical threshold, difficult construction, long ecological cycle, and long revenue benefit cycle. Although decades of industry accumulation can more quickly understand the industrial knowledge, but to build a healthy ecology, not overnight.

High cost, heavy model.

Emphasis on resources, capital, talent, knowledge. Innovative business technologies must rely on years of huge investment to occupy the top. And technology, ecology, talent, operation…… Any one of them is a money shredder.

1762-IQ16

In short, the business model path of the industrial Internet circuit is not yet fully formed. The further we go, the more contradictions will become apparent.

Conflict between enterprises and shareholders: shareholders don’t like it

“From the perspective of the whole group, a department that continues to lose money while investing in research and development is difficult to survive in a traditional organization.” The PE value of traditional listed companies is placed there, it has been burning money and market value, shareholders are not satisfied, the pressure is pushed backwards, and they have to consider separation.” An industrial Internet head company CEO said to Leifeng network.

Share prices are difficult to help, 1762-IQ16 PE is difficult to push, and traditional enterprises have a common market value anxiety.

“High-tech labels of scientific and creative enterprises PE can have dozens or even hundreds of times, traditional manufacturing enterprises are more than ten times, traditional manufacturing enterprises PE is very low, with high-tech enterprises can not be compared.” Tan Li pointed out that traditional manufacturing enterprises are old guns in the industry, but they are a few points lower in the face of high-tech enterprises.

At the same time, the entire industrial Internet industry is in its infancy, and it is difficult to bring objective income returns to the main body during the investment period of several years.

Not revenue, but growth?

If the growth rate of new business is not as expected, or the growth rate of the group’s main business can not keep up with the burn rate of new business, profits shrink, and the low stock price is even more inevitable.

In particular, investors in the secondary market have a keen sense of 1762-IQ16 perception and different levels of corporate distress, and may lead to a large sell-off as soon as they encounter negative factors.

After all, not everyone has enough trust in a business’s new business, and not everyone has enough patience to hibernate and pay for your years-long dream.

For large listed companies, it is one of the primary responsibilities to be responsible for the stock price and shareholders. As a public company, they have to consider the negative impact of performance on the stock price.

1 Year Warranty

1 Year Warranty