This year’s government work report proposed to strengthen financial support for stable enterprises. Industry insiders believe that the manufacturing industry and micro, small and medium-sized enterprises credit support policy will continue to increase, credit resources will continue to incline to inclusive areas, and there is still some room for banks to make profits in the real economy.

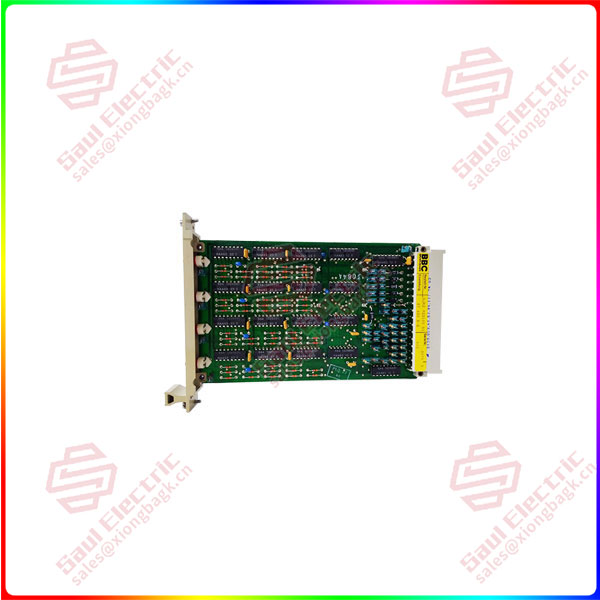

DT680E GJR2923100R1 DT680B-E Credit resources will be tilted towards the inclusive sector

The government work report proposed that the policy of postponing the repayment of principal and interest on loans to micro, small and medium-sized enterprises should be extended to the end of March next year, and loans to inclusive small and micro enterprises should be extended as much as possible, and loans to other difficult enterprises should be extended. Banks are encouraged to significantly increase credit loans to small and micro enterprises, initial loans, and non-repayment of principal. The growth rate of inclusive loans to small and micro enterprises by large commercial banks is more than 40%.

DT680E GJR2923100R1 DT680B-E

“Policies to support micro, small and medium-sized enterprises and benefit all small and micro enterprises have been further strengthened.” Wang Yifeng, chief analyst of the banking industry at Everbright Securities (11.250, -0.06, -0.53%), said that in recent years, the financial services of small and micro enterprises have basically continued the characteristics of “increment, price reduction, expansion and quality improvement”, but there are also problems such as low first loan rate, low proportion of credit, less service customers, and difficulty in obtaining medium and long-term credit. At present, the policy environment for small, medium and micro enterprises and inclusive small and micro enterprises is very good, DT680E GJR2923100R1 DT680B-E and the supervision and assessment of small and micro financial services will focus on improving the proportion of credit loans, the first loan rate, and the proportion of medium and long-term loans, and credit resources will continue to tilt towards inclusive fields.

Wen Bin, chief researcher of China Minsheng Bank, said that the government work report retained the requirement of “inclusive small and micro enterprise loan growth of large commercial banks”, which was raised by 10 percentage points, reflecting the government’s determination to protect small and micro enterprises.

1 Year Warranty

1 Year Warranty