Overview of flash memory market conditions at the end of 2023

short-term

Global supply chains, inflation, and geopolitical issues will continue to hamper demand.

With the profit margin of the leading manufacturers hitting a record low, the growing cost input has brought greater challenges to the competitive situation of the flash market.

long-term

The flash memory market is driven by emerging megatrents that are driving the demand for data computing and storage for on-premises, edge and cloud applications.

Flash technology-based SSDS are gradually replacing HDDS, further driving flash demand.

Key drivers of future flash consumption

Enterprise SSDS used by very large and traditional enterprise Oems

PCS and games this uses SSD

Storage in smartphones/other mobile devices

Demand for AI/VR/IoT devices

Automatic driving

Flash Memory quarterly revenue by vendor for 2022-24

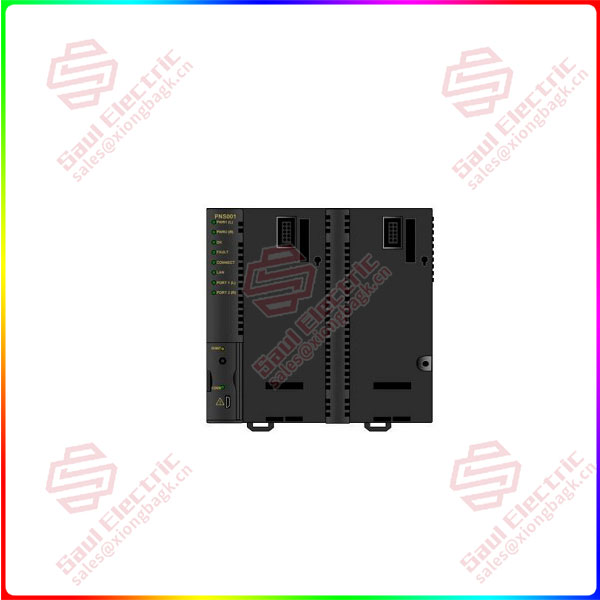

IC200PNS001

Global SSD shipments in 2022-2023

■ Global SSD shipments: Global shipment growth is expected to be higher in the third quarter of 2023 than in the second quarter.

Flash memory supply, demand and price trends in 2022-2023

■ Price action: NAND Flash’s price action is almost in line with contract lows, with a slight rebound expected in the fourth quarter.

■ Satisfaction rate: The oversupply of NAND Flash will improve in the fourth quarter.

Global memory production in 2022-2023

■ Global DRAM production: Memory manufacturers’ production reduction strategy has been fully implemented from the second quarter to the third quarter of this year, but capacity may increase after memory inventory levels effectively decline.

DDR4 memory supply, demand and price trends in 2022-2023

■ Price action: Memory spot prices are likely to rise slightly by the end of 2023, while D4 8Gb contract prices remain below spot price levels.

■ DRAM satisfaction rate: Due to the production reduction strategy implemented by manufacturers, the situation of memory oversupply continues to improve.

1 Year Warranty

1 Year Warranty