Dongguan is, quite literally, a thermometer to measure the warmth of China’s export industry. Now the scale is dropping dramatically.

At the end of July, the Dongguan Bureau of Statistics disclosed several surprising data: in the first half of 2023, Dongguan’s regional gross domestic product (GDP) grew by 1.5% year-on-year, not only lower than the first quarter of this year, but even slightly lower than the same period in 2022, which has not yet been unlocked. What is even more disturbing is that Dongguan, a leading export city, had the lowest GDP growth rate in the whole Guangdong province in the first half of the year. Only four years ago, Dongguan’s half-year total import and export growth rate remained at 6.8%, contributing 96.4% to the province’s foreign trade growth.

Over the past 30 years of reform and opening up, Dongguan has exported home appliances, electronic products, clothing, shoes and bags to the world, and overseas markets have made this impoverished village a wealthy city with a per capita GDP second only to Shenzhen.

It is also because of its close relationship with the global market that foreign trade cities like Dongguan are particularly sensitive to changes in the outside world. It is the canary in the mine, bearing the brunt of the general trend of globalisation reversing and the economic cycle entering a trough.

Behind the decline in Dongguan’s data, there are more alarming and disturbing facts. Dongguan has not been able to complete industrial upgrading for many years. Throughout 2022, the bulk of Dongguan’s exports are still mechanical and electrical products, accounting for 67.9%, while high-tech products account for only 30%, and exports are still declining. From the data alone, it is still an export city dominated by traditional products.

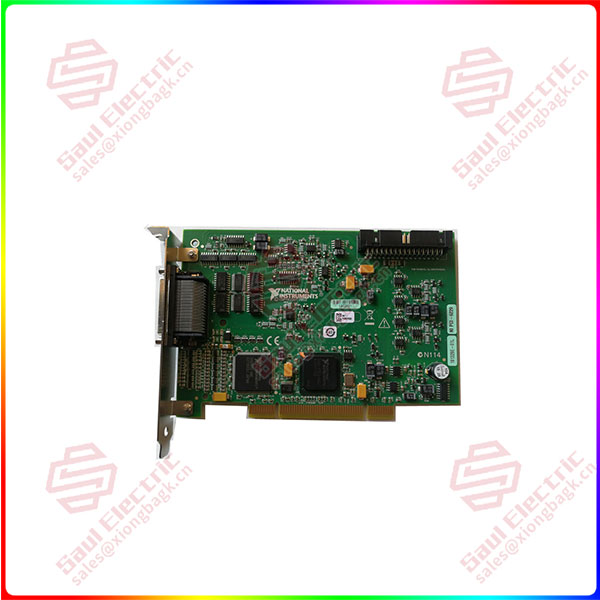

PCI-6229

After eating enough of the dividends of globalization, Dongguan stands at a crossroads. If the export structure cannot be changed, with the aging of the population, the relocation of the low-end industrial chain, and the intensifying competition in the domestic foreign trade industry, Dongguan may fall into a negative spiral, and after many years, it will become a declining and mediocre city.

Alternation of new and old

In fact, Dongguan has already completed an upgrade.

In the early years, Dongguan and Hong Kong formed a “front shop after the factory” combination, relying on the production of clothing, shoes and hats, small household appliances, bags and bags, many factories accumulated the first bucket of gold.

However, the technical threshold of such products is low, and factories compete with each other for cheap land and labor. After economic development, the rise in land prices and labor prices is inevitable, and such industries will inevitably flow to regions with lower processing costs. Simply substituting household goods may help a poor city make a quick buck, but it will not help it prosper in the long run.

Fortunately, Dongguan was just in time to catch the next wave of products: consumer electronics.

In 1995, Nokia landed in Dongguan. Since then, Dongguan has turned to higher-level mechanical and electrical products for export. The release of the iPhone opened the tide of intelligent machine replacement, and Dongguan, relying on the accumulation of years of consumer electronics manufacturing experience, soon became a global mobile phone export. Among the top five mobile phone brands, vivo and OPPO factories are located in Dongguan, and Huawei also exports some products from Dongguan. In the first half of 2019, Dongguan exported mobile phones as high as 64.6 billion yuan, and the mobile phone exports of OPPO, vivo, Huawei and other leading companies accounted for 17% of Dongguan’s overall exports.

But the smartphone-switching boom cannot last forever. In 2016, global smartphone shipments declined for the first time, and have since declined all the way down, to 2022, global smartphone shipments hit a nine-year low, with a double-digit decline. It can be said that the smart phone industry has bid farewell to the growth period and completely entered the boring stock market.

This time, Dongguan has failed to find a second growth curve. In the first half of 2023, Dongguan’s exports of computer, communication and other electronic equipment manufacturing fell by 4.9%. The cold wave in the mobile phone market has made the world’s factories feel the pain that cannot be avoided.

1 Year Warranty

1 Year Warranty