On the evening of October 24, according to the latest data disclosed by the Hong Kong Stock Exchange, the United States Group formally submitted an application for listing.

Looking back on the history of the United States Group’s listing in Hong Kong, in August this year, the United States Group announced that it was issuing securities overseas (H shares) and carrying out preliminary demonstration on listing matters. On September 18 this year, the board of directors of Midea Group held a meeting to consider and pass the relevant proposals on the company’s issuance of H shares and listing on the Stock Exchange of Hong Kong Limited. More than a month later, Midea Group formally submitted the application for listing in Hong Kong. Once listed on the Hong Kong Stock Exchange, Midea Group will achieve both Hong Kong and A-share listing.

The reason for its listing in Hong Kong, according to the explanation of the United States Group, the move is mainly based on the need to deepen the global strategic layout.

From the perspective of business coverage, so far, Midea has about 200 subsidiaries, 31 research and development centers and 40 main production bases around the world, with more than 190,000 employees and business coverage in more than 200 countries and regions.

Guotai Junan analysis believes that the United States Group is currently entering an important stage of overseas development, whether it is the next step for overseas brand mergers and acquisitions, or overseas staff incentives, the H-share platform will play a more convenient role.

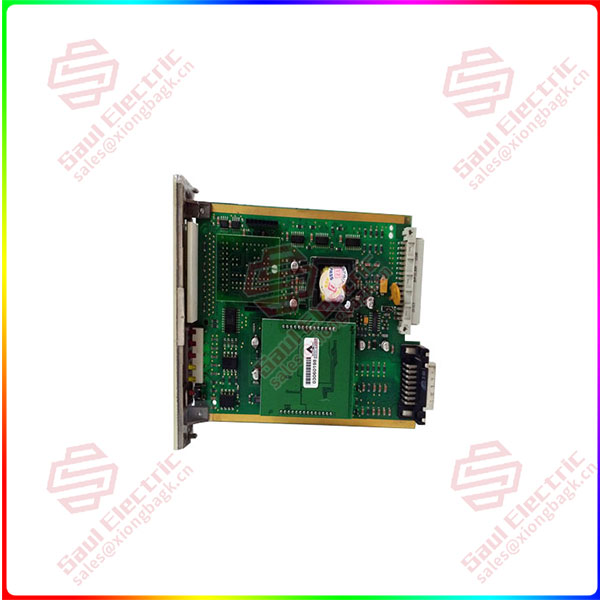

05701-A-0302

Lens company research founder Kuang Yuqing said that the United States group itself is not short of money, the main purpose of the IPO in Hong Kong speculation should not be to raise funds, mainly in order to better promote the internationalization of its business, enhance its international layout, expand its international influence. Midea’s opening of the “A+H” dual financing platform is conducive to the close connection of its international and domestic markets, and further broaden financing channels and improve financing efficiency.

As one of the three giants in the A-share home appliance sector, the United States Group has been concerned in the capital market.

In recent years, Midea Group has acquired Toshiba White Power, Germany’s Kuka, Italy’s Clivet and other companies to extend to the global market. In addition to the international layout, the capital territory of the A-share market of the United States Group has also been gradually expanding in recent years. Since 2020, the company has acquired two listed companies, Hekang New Energy and Wandong Medical, and won the control of Kelu Electronics in 2023. Today, the United States Group two piles of “A demolition A” is also under way.

In April this year, the United States Group spin-off subsidiary “United States wisdom photoelectric” was accepted for listing, and has now entered the inquiry stage. In late July, Midea Group launched the preparatory work for the spin-off of its subsidiary “Ande Zhailian” to be listed on the main board of the Shenzhen Stock Exchange. If the IPO of these two subsidiaries can be realized, the number of listed companies under the Midea Group will reach 5.

Since the beginning of this year, the A-stock market value of the United States Group has always remained at more than 380 billion yuan. However, the Hong Kong listing of Midea Group has not had much impact on boosting the share price. As of press time, the total market value of Midea Group A shares fell slightly to 370 billion yuan.

1 Year Warranty

1 Year Warranty