TE Connectivity (” TE “) today announced its financial results for the fourth quarter and full year ended September 29, 2023.

Fiscal fourth quarter highlights

Net sales of $4.0 billion were essentially flat compared to sales in the fourth quarter of fiscal 2022, a 13-week calculation period, a natural decrease of 2%.

GAAP diluted earnings per share from continuing operations were $1.75, down 21% year-over-year.

• Adjusted earnings per share were $1.78, an increase of 2% on a comparable 13-week calculation period.

Order volume was $3.9 billion, with sequential growth in orders for transportation solutions and communications electronics solutions.

Cash flow from operating operations was $1.1 billion and free cash flow was $945 million, both quarterly highs. The company continues to demonstrate a strong cash generation model.

Fiscal highlights

Net sales for the fiscal year were $16 billion, essentially flat compared to the prior fiscal year (52-week calculation period), despite a $430 million loss due to unfavorable foreign exchange rates. The company’s sales grew naturally by 3%, driven by growth in transportation solutions and industrial solutions.

GAAP earnings per share from continuing operations were $6.01, down 20% year-over-year.

• Adjusted earnings per share were $6.74, down 6% year-over-year on a comparable 52-week basis.

• Strong profit and earnings per share growth in the second half over the first half, driven by strong operating results.

Cash flow from operating operations was $3.1 billion and free cash flow was $2.4 billion, both company records, returning approximately $1.7 billion to shareholders.

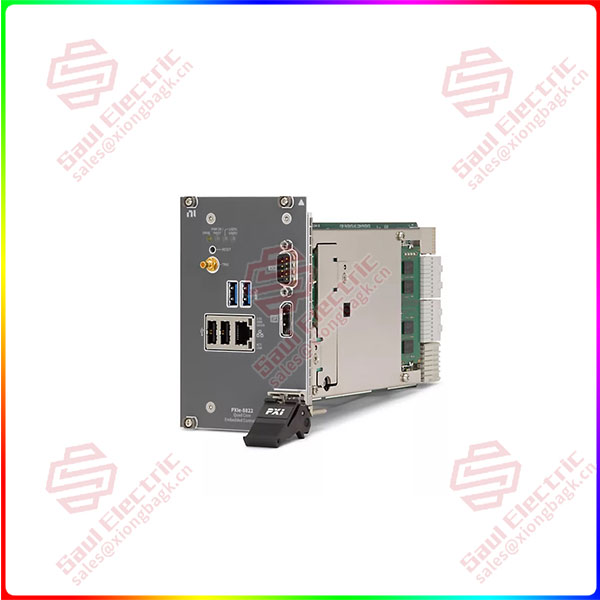

PXIE-8822

Mr. Terrence Curtin, TE Connectivity’s Chief Executive Officer, said, “I am pleased with our strong finish to fiscal 2023, as we delivered higher than expected earnings, record cash flow and a free cash flow conversion rate of more than 100% during the quarter. Looking at the full year, transportation solutions and Industrial solutions achieved year-over-year natural sales growth. This is due to the strength and diversity of TE’s business portfolio, allowing us to weather cyclicality and currency headwinds in some of our end markets. In the transportation segment, TE continues to drive sales growth with its global leadership in electric vehicles; More importantly, it boosted profits in the second half of the year. TE’s industrial solutions show continued momentum in renewable energy applications and benefit from the continued recovery in the commercial aviation and medical markets. While communications electronics solutions (sales) generally declined in fiscal 2023 as expected, we are seeing positive momentum in AI applications. TE’s high-speed connectivity solutions and engineering expertise in this area have won us key projects from technology leaders.”

“Looking ahead to the coming year, while we remain in a dynamic market environment, we are confident in our ability to capture key trends including e-mobility, renewable energy and artificial intelligence to drive profitable growth.” In these areas, our advanced technologies and close customer partnerships are helping us create a safer, sustainable, efficient and connected future.”

Fiscal 2024 first quarter results Outlook

For the first quarter of fiscal 2024, the Company expects net sales of approximately $3.85 billion, which is expected to be flat year-over-year, with natural sales flat. GAAP earnings per share from continuing operations are expected to be approximately $1.59, an increase of 27% year-over-year. Adjusted earnings per share are expected to be about $1.70, up more than 10% year-over-year, with strong profit growth.

1 Year Warranty

1 Year Warranty