November 28, machine vision industry leader Stech listed today.

Since its establishment, Stech has been deeply engaged in the field of machine vision inspection equipment, and has built leading technical reserves in the field of machine vision through continuous independent research and development and technological innovation in the field of mechatronic-optical integration technology such as 3D light source technology, image processing and application layer algorithms, AI artificial intelligence algorithms, and high-precision three-axis mechanical platforms.

Stech is a high-tech enterprise specializing in the research and development, production and sales of machine vision inspection equipment, and has been recognized as a national-level “specialized and special” small giant enterprise. The company’s terminal products cover consumer electronics, automotive electronics, lithium batteries, semiconductors, communication equipment, etc., and its products have been recognized by well-known downstream manufacturers such as Foxconn, Desai Battery, Hikvision, and Hongxin Electronics.

The company’s operating income from 2020 to 2022 will be 253 million yuan / 356 million yuan / 387 million yuan respectively. The net profit returned to the mother was 78 million yuan / 117 million yuan / 116 million yuan. In the latest reporting period, 2023Q1-Q3, the company achieved operating income of 272 million yuan, -9.18% year-on-year, and net profit of 83 million yuan to the mother, -12.61% year-on-year. The company expects to achieve net profit attributable to shareholders of the parent company in 2023 of about 103 million to 110 million yuan, a change of -11.87% to -5.42% over the same period last year.

Machine vision industry chain analysis

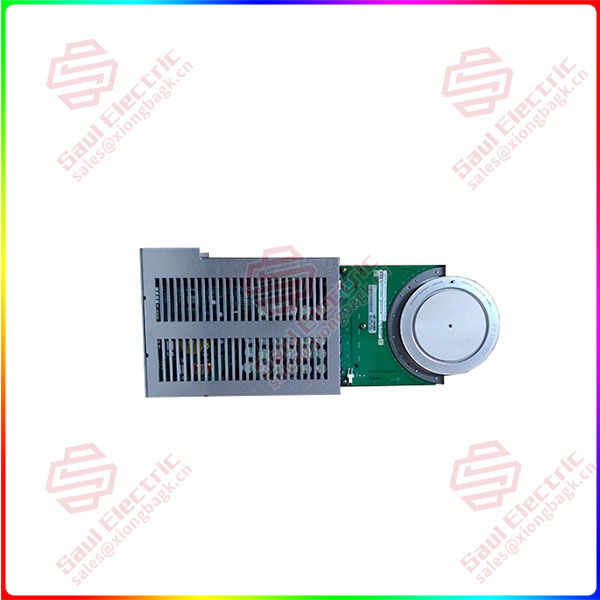

5SHY3545L0020

At present, machine vision equipment manufacturers, Tianzhun technology, moment technology and Meiya optoelectronics, etc., show strong market competitiveness, machine vision system integrators representative enterprises including Ling Yunguang, precision measurement electronics, etc., machine vision system solutions on behalf of enterprises are Merkamand, Achu technology. In the upstream hardware field of the machine vision industry chain, Lianchuang Electronics, Hikang Robot, Opte, and Beijing Junzheng are typical manufacturers in the field of optical lenses, industrial cameras, light source equipment and image processing.

In 2021, the booming development of logistics warehousing and new energy industries has driven the expansion demand of related enterprises, and the demand for visual inspection products has increased significantly. GGII data shows that the size of China’s machine vision market in 2021 is 13.816 billion yuan (the data does not include the scale of automated integrated equipment), an increase of 46.79%. Among them, the 2D vision market is about 12.665 billion yuan, and the 3D vision market is about 1.151 billion yuan. The recovery of traditional industrial products has also brought vitality to machine vision, and the growth trend is obvious.

China’s machine vision industry is accompanied by the development of China’s industrialization process and the rise of China is becoming one of the world’s most active machine vision development areas, the scope of application covers almost all areas of the national economy. In 2021, affected by the downstream demand growth of logistics warehousing and new energy industries, the demand for visual inspection products has increased significantly. According to the data of the high-tech Robot Industry Research Institute, the size of China’s machine vision market in 2021 reached 13.816 billion yuan, an increase of which the 2D vision market size was 12.665 billion yuan, and the 3D vision market was about 1.151 billion yuan. According to GGII, by 2025, China’s machine vision market will reach 46.9 billion yuan, with a compound growth rate of 36% from 2021 to 2025. Combined with the growth of the market size of China’s machine vision industry and the forecast of the high-tech robot Industry Research Institute, it is expected that China’s machine vision industry will continue to maintain rapid growth in 2026-2028, among which, with the gradual upgrade of 2D vision to 3D vision, the 3D vision market is conservatively predicted to grow at a growth rate of 50%. The 2D vision market is growing at a 10% rate. By 2028, the market size of China’s machine vision industry will reach 83.7 billion yuan.

“The machine vision industry is gradually maturing, and the market size has developed rapidly with the growth of the Chinese manufacturing and industrial robot market. From the perspective of the industry chain, the products covered by the upper, middle and lower reaches of machine vision empower thousands of industries and become an indispensable force to promote the development of the robot industry.” Gao Gong robot industry Institute director Lu Hanchen said.

1 Year Warranty

1 Year Warranty