Midstream: ontology manufacturer

As a typical mechatronics product, machine tool is the combination of mechanical technology and CNC intelligence. From the perspective of product distribution, machine tools are mainly based on metal cutting machine tools, followed by metal forming machine tools and special processing machine tools.

Metal cutting machine tools are used for cutting, grinding and other processing methods to process metal workpieces, the most extensive application range, the highest proportion of CNC machine segmentation products, is the most important fine molecule industry of machine tools, accounting for about 2/3 of the domestic metal processing machine tool consumption. According to China Customs data, from January to June 2023, the import value of metal cutting machine tools was 2.62 billion US dollars, down 7.8% year on year; Metal cutting machine tool exports of 2.64 billion US dollars, an increase of 36.2%; In terms of trade balance, metal cutting machine tools showed a surplus for the first time, with a surplus of $20 million.

Industrial machine market size and output value

Global market size and output value

According to the official data released by the German Machine Tool Manufacturers Association (VDW), from the perspective of supply, the total output value of the global machine tool industry in 2022 is about 80.3 billion euros, and China ranks first in the world with a total output value of 25.7 billion euros, accounting for 32% of the global market, followed by Japan and Germany, with an output value of 9.9 billion euros and 9.7 billion euros, respectively. In the global market share of 12%.

From the perspective of demand, the consumption of the global machine tool industry in 2022 is 80.8 billion euros, China ranks first in the world with a scale of 26 billion euros, also accounting for 32% of the global market, followed by the United States and Germany, with consumption of 9.7 billion euros and 5.2 billion euros, respectively, accounting for 12% and 7% of the global demand market. From the perspective of both supply and demand, the total size of the top three countries accounts for more than 50% of the global market size.

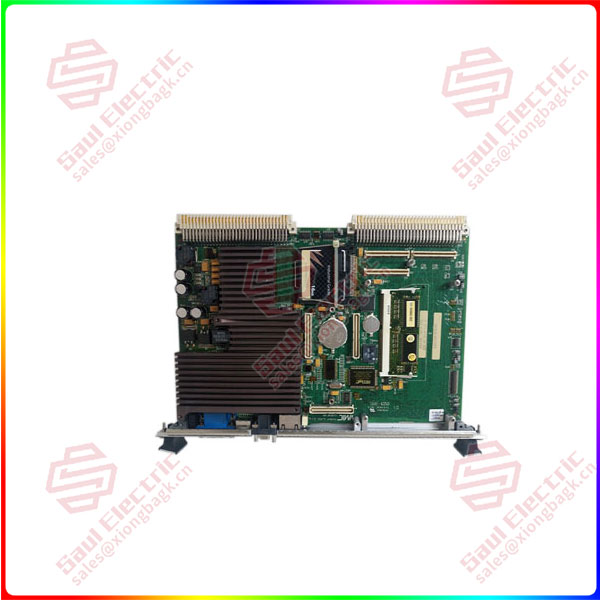

IS215UCVEH2AE+TPMC815-11=IS215UCVEM08B

Chinese market size and output value

Since China’s accession to the WTO, the rapid growth of the machine tool industry, according to the data released by the China Machine Tool Industry Association, 2001-2011 China’s metal processing machine tool production and consumption increased from $3.97 billion to a high of $39.09 billion, a compound annual growth rate of 25.70%. Since then, with the upgrading of the domestic economic structure and supply-side reform to reduce production capacity, domestic machine tool consumption has experienced a 10-year decline. In 2020, affected by the epidemic, the consumption of metal processing machine tools reached a low of $21.3 billion since 2011.

According to the China Machine Tool Industry Association estimates, in 2022, China’s metal processing machine tool production of 27.11 billion US dollars, an increase of 5.1%, of which metal cutting machine tool production of 17.22 billion US dollars, an increase of 3.3%; In 2022, the consumption of metal processing machine tools in China was 27.41 billion US dollars, down 1.9% year-on-year, of which, the consumption of metal cutting machine tools was 18.44 billion US dollars, down 4.3% year-on-year.

According to the characteristics of the previous “3-year update” cycle of machine tool equipment, the domestic industrial machine market will decline in 2023.

1 Year Warranty

1 Year Warranty