Improved service adaptation

The development of manufacturing enterprises often needs to invest a lot of capital, especially advanced manufacturing enterprises are prone to financing difficulties and expensive bottlenecks in the development process. How do financial institutions innovate products and upgrade services to crack the pain points?

Hunan Zhongwei New Energy Technology Co., Ltd. is a comprehensive service provider of lithium battery cathode material precursor. The company focuses on the industrial chain layout of key power battery manufacturers and consumer battery manufacturers. “In the first half of this year, Zhongwei’s ternary precursor export market share increased from 26.6 percent in 2022 to 27.1 percent.” Zhou Wenxing, deputy general manager of the capital center of Zhongwei Group, said in an interview with the Economic Daily reporter that overseas, the company has built an Indonesian raw material base, and is now starting to plan an international industrial base.

It is understood that with the development of the new energy vehicle market, the power battery material industry is attracting a large number of new enterprises to join, the industry competition is becoming increasingly fierce, the company’s business scale growth at the same time, financing needs are also increasing. Zhang Qiang, general manager of Corporate Finance Department/Strategic Customer Department of Everbright Bank Changsha Branch, said that Zhongwei Shares hope to promote industrial investment and asset structure balance through equity financing, bank financing, retained earnings, bond financing and other ways, Everbright Bank will provide customers with personalized solutions and customized services, combined with online and offline products to promote the company to become bigger, better and stronger.

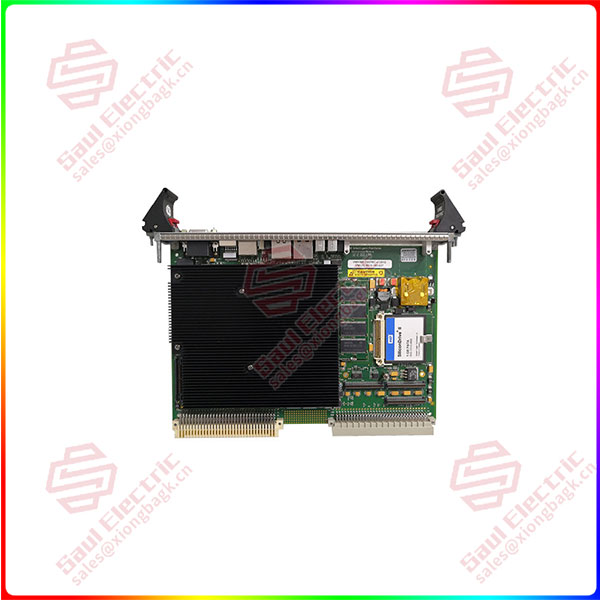

VME-7807RC VME-7807RC-410000 350-930078074-410000 G

Zhou Jing, assistant governor of Everbright Bank Changsha Branch, told reporters that for manufacturing enterprises, Everbright Bank Changsha Branch has implemented a series of credit support measures: First, focus on supporting the four national advanced manufacturing industry clusters and characteristic industries in Hunan Province; The second is to implement pricing concessions and actively promote the “Red Star Plan”. Star credit customers in key real economy areas such as manufacturing, give different degrees of FTP reduction concessions according to the star, and synchronously match green channel policies such as priority approval and priority delivery. Third, establish a “one case, one discussion” mechanism. For key projects and key customers, specify special personnel to coordinate and promote, make good use of risk pre-examination, arrange approval green channels, expand pricing authorization and other head office support policies.

In different stages of development, enterprises have different needs for financing. In the process of serving manufacturing industry, financial institutions also need to improve the adaptability of financial services. The research report released by the Bank of China Research Institute mentioned that China has a vast market and a good manufacturing base, and the transformation and upgrading of the manufacturing industry has accelerated in recent years, and the industrial structure has been optimized. In the process of promoting the transformation and development of the manufacturing industry, technological innovation is the key, we should attach importance to the important value of the traditional manufacturing industry, adapt to the changes in the transformation needs of the manufacturing industry, improve the mode of personnel training, improve the implementation of industrial policies, give play to the role of the domestic market to consolidate the foundation and advantages of the manufacturing industry chain, and improve the adaptability of the financial service model to the transformation and development needs of the manufacturing industry.

1 Year Warranty

1 Year Warranty