Where are the investment opportunities in the robotics industry?

The robotics industry is an area full of innovation and change, and with the development of technology and the growth of market demand, investment opportunities in this industry continue to emerge. However, as with any new industry, investment in robotics comes with risks.

First of all, the investment opportunities in the robotics industry lie in those enterprises that really have the value of landing applications. Investors should evaluate these companies with technology drivers at their core, focusing on their research and development strength, innovation, and ability to solve real problems. For example, in industrial production, efficient automated robots and precise operational design are essential to improve robot efficiency and reduce robot costs; In the field of healthcare, intelligent care robots and surgical assistance robots can improve the quality and safety of medical services. Therefore, choosing companies with core technologies and commercial applications is the key to seizing investment opportunities in the robotics industry.

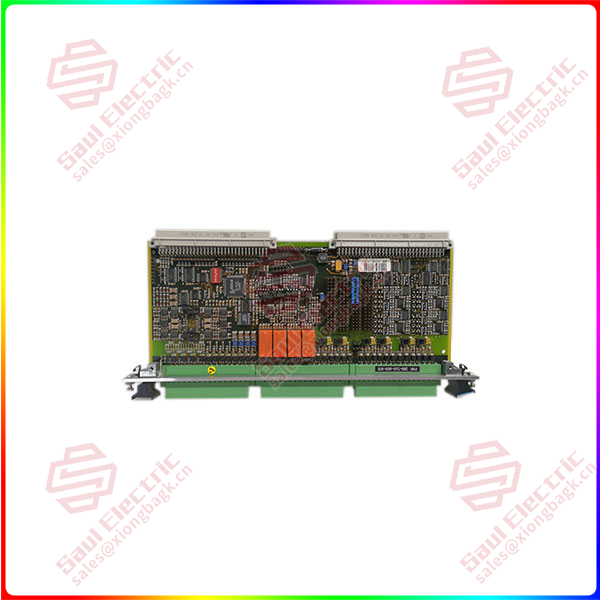

VM600 IOC4T

Second, while the robotics industry is promising, it is volatile as part of advanced manufacturing. The price fluctuations of individual stocks can be very significant and are prone to risk events. This requires investors to have a certain risk tolerance and long-term investment perspective. In addition, since robotics involves the intersection of multiple disciplines, such as artificial intelligence, machine vision, sensor technology, etc., it is particularly important to understand the technology of enterprises and judge the industry trend.

Given the high volatility and complexity of the robotics industry, it is recommended that investors be positioned through index funds as much as possible. An index fund is a diversified investment vehicle that tracks a specific market index and contains shares of a range of related companies. By investing in robot-related index funds, investors can reduce the risk of a single company to some extent, while enjoying the growth benefits of the entire industry. For example, Tianhong recently launched the Tianhong China Securities Robot ETF connection, the Tianhong China Securities Robot ETF on the floor, and so on.

In the long term, the opportunities of the robot circuit are diversified, including but not limited to industrial automation, home services, medical health, education and entertainment and other fields. However, corresponding risks also exist, such as the uncertainty of technological breakthroughs, intensified market competition, and changes in policies and regulations. Therefore, in order to find and seize investment opportunities in the robotics industry, investors need to really sink their minds to deeply study the industry dynamics, market demand and competitive landscape in order to make more informed investment decisions.

1 Year Warranty

1 Year Warranty