According to Interact Analysis’s latest “Gear Motors and Industrial Gearboxes” research report:

In 2023, the global general purpose reducer (gear motors and industrial gearboxes) market is expected to reach $14.2 billion in sales, down 0.7% from 2022. The global market is expected to contract further in 2024, but will return to a steady growth trajectory from 2025 onwards.

Industrial reducer is widely used in various industries, of which conveyor is the largest application market, and the growth prospects are broad. Over the next five years, we expect the compound annual growth rate (CAGR) of general purpose reducer sales in the unit conveyor and bulk conveyor industries to be higher than the market average.

From the perspective of market pattern, the general reducer market concentration has increased, and leading manufacturers have continued to gain share, but there are also challengers with rapid growth in volume in some regions or product types of markets.

The market size is expected to decline in 2023 and 2024

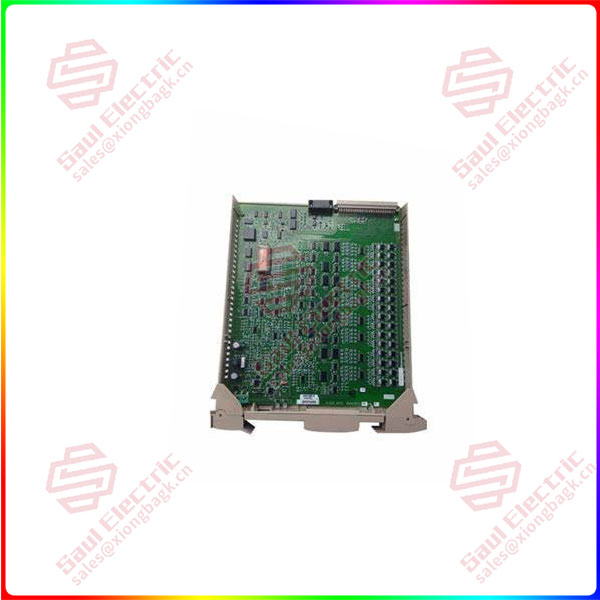

51304754-150 MC-PAIH03

General Motors’ sales revenue is expected to return to growth after 2024

In 2023, General Motors’ sales revenue in the Asia-Pacific market is expected to decline by 4.8%, while the Americas and European and African (EMEA) markets are expected to achieve 3.8% and 1.5% growth, respectively.

The general reducer market in Asia and Pacific has been greatly affected by the Chinese market. The ongoing downturn in the real estate industry in 2023 has had a significant impact on the steel and cement industries, while the boom in post-epidemic lithium battery manufacturing equipment is also cooling. Based on the positive economic policies in the second half of the year, we believe that the growth rate of the Chinese market has signs of bottoming out in 2023, and the decline is expected to narrow in 2024. At present, most of the general reducer manufacturers in the survey believe that the sales situation will take some time to improve.

In 2023, the Indian and Indonesian markets led the growth of the general purpose reducer market in the Asia-Pacific region, but affected by the global economic downturn, these markets are also expected to contract in 2024.

In terms of the American market, due to strong demand from the US mining and steel industry in the first half of the year, sales of reducer products maintained growth in 2023. However, since the beginning of the third quarter, the market has seen a decline in new orders, indicating the beginning of a downward economic cycle. Since mid-2022, the US Treasury yield curve has consistently inverted, which is often seen as an early warning of a recession. In our research on the reducer market, local manufacturers in the Americas generally believe that the sales situation next year is not optimistic.

In the European and African (EMEA) markets, the strong recovery of the automotive industry is driving the growth of the local General Motors reducer market in 2023. In addition to the automotive industry, most of the application industries of the reducer have performed generally or even in a downturn in Europe this year. In the European general gear reducer market, the proportion of light products (modular gear reducer) is higher than that in the Asia-Pacific and American markets, mainly due to the strong position of the European machinery manufacturing industry. Based on expectations of weak global manufacturing demand, our outlook for European machinery production in 2024 is negative.

1 Year Warranty

1 Year Warranty