“In the next five years, we must deeply explore the connotation and extension of the ‘express economy’, and cultivate and expand related industries and supporting services.” At the national postal Administration teleconference held at the beginning of the year, Ma Junsheng, director general of the State Post Bureau, elaborated on the new goals for the development of the postal express industry in the next five years.

In fact, the rapid development of China’s express delivery industry in recent years has led to the vigorous development of the intelligent logistics equipment industry. In the past six months, Dema Technology landed on the science and Technology board, Zhongke Micro to impact IPO, Suzhou Jinfeng received 100 million yuan of financing, automatic sorting equipment manufacturers began to enter and active in the capital market.

In the view of industry experts, the reasons for the popularity of automated sorting are needless to say. “On the one hand, the industry characteristics of large business volume and dispersed business sources make efficient sorting centers a necessary choice to improve operational efficiency and accuracy; On the other hand, the competition among express delivery enterprises is intensifying, the average unit price of express delivery is gradually declining, and the establishment of automated sorting centers has become an important way for enterprises to control costs.”

Sweat sorting moves to smart sorting

On the whole, the large-scale application of automated sorting equipment has greatly improved the operating efficiency of express delivery enterprises. Taking Shentong Express Guangdong Zengcheng Transfer Center as an example, it has introduced a new automatic sorting equipment such as 3-layer cross belt, swing arm and telescopic machine in 2020, and the maximum daily processing capacity is expected to reach 10 million pieces, and the production capacity has increased by 50%. Set capacity of 460,000 units/hour, an increase of 1100%.

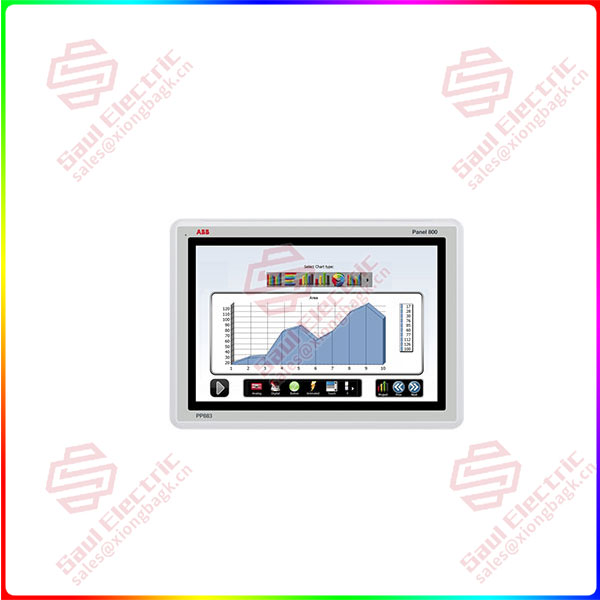

PP887S 3BSE092987R1

The automatic sorting equipment of YTO transfer center is independently developed by its Yuanzhi Automation company, and nearly 200 sets of automatic lines have been built in more than 60 express transfer centers across the network in the past three years. In the Chengdu transit center, the 4-layer automatic sorting equipment independently developed by Yuanzhi Automation Company was put into use before the “Double 11” last year, and the daily processing volume of express parcels is twice that of the original site. According to Yang Jun, head of the operation management department of YTO Sichuan Province, after the automation equipment is put on the line, the operator only needs to place the express on the conveyor belt face up on the package table, the express face sheet is automatically scanned and coded, and under the delivery of the pallet, it automatically falls to the grid on both sides of the conveyor belt according to the corresponding code. With the same amount of incoming pieces, the operation time of 5 to 6 hours can be saved after the equipment is online, and the per capita efficiency can reach 1500 pieces/person during the peak season.

How stark is the contrast? Perhaps only those who have been there know better. In the summer of 2015, the reporter walked into the Beijing distribution center of a express company, surrounded by dozens of sorters on both sides of the assembly line, sweating them in turn to pick up the express to quickly view the waybill information, and then use the “big pen” to mark the waybill, with experience to determine the next station of the express. In 2018, when the reporter entered the company’s distribution center again, it had changed the world, the amount of express mail doubled, the “big pen” disappeared, and the sorters were reduced by half. The reason is that advanced automated sorting equipment has replaced the traditional manual sorting line, and “sweat sorting” is changing to “intelligent sorting”.

It is worth noting that express companies spare no effort to promote automated sorting, which is not only about operational efficiency, but also about operating costs. Guotai Junan Securities transportation team analysis believes that the future express delivery leader is the most extreme cost efficiency performance, the most leading enterprise. Especially for franchise express companies, whether reasonable, efficient and flexible arrangements for transportation and transit are directly related to the profitability of express companies. Before 2016, all express delivery companies were in the stage of network construction, the larger the single volume, the lower the cost of single distribution; After 2016, the number of express orders to a certain scale, the decline in manual operation efficiency in the peak season is more prominent, and the company that took the lead in laying out automatic sorting equipment at this stage has significantly reduced the cost of single ticket distribution.

1 Year Warranty

1 Year Warranty