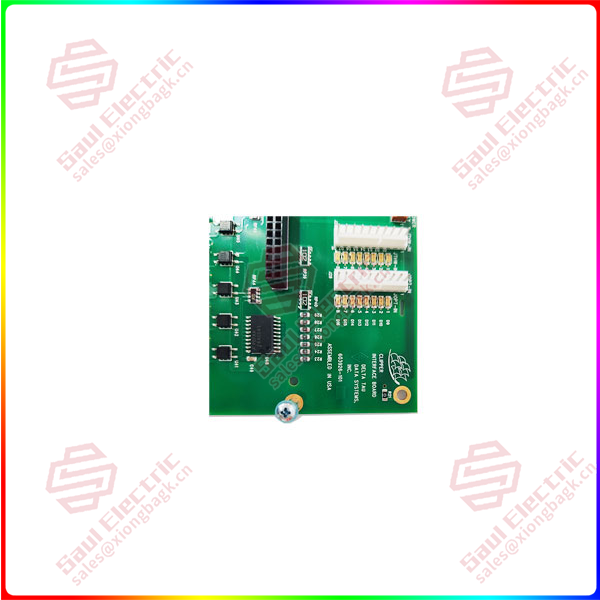

CLIPPER INTERFACE BOARD 603926-101 “In the first three quarters of this year, the country added 910.1 billion yuan in tax and fee cuts, including 788.9 billion yuan in tax cuts and 121.2 billion yuan in fee cuts.” At The State Council policy routine briefing held on November 5, Wang Daosu, deputy director of the State Administration of Taxation, said that entering the third quarter, in view of the new situation and new challenges in economic operation, especially the impact of rising commodity prices and rising production costs on the industrial economy, especially on manufacturing enterprises, the state has introduced tax and fee reduction policies based on Further increased the policy of allowing enterprises to enjoy the additional deduction of research and development costs in the first three quarters in advance, the implementation of phased tax suspension measures for small and medium-sized enterprises in the manufacturing industry, and the implementation of “reduction, refund, and delay” tax measures for coal power and heating enterprises, helping enterprises to rescue and solve difficulties, and boosting the confidence of market players.

CLIPPER INTERFACE BOARD 603926-101 Help small and micro enterprises to grow bigger and stronger

Small and micro enterprises are an important source of China’s economic vitality and the “main force” to absorb employment. How is the overall enjoyment and effectiveness of the preferential tax policy for small and micro enterprises?

CLIPPER INTERFACE BOARD 603926-101 CAI Zili, director of the Department of Revenue Planning and Accounting of the State Administration of Taxation, said that since 2019, the State has introduced a series of preferential tax policies for small and micro enterprises, and the policy intensity is constantly increasing, and the policy effect is gradually emerging.

From the effect of the policies that have been introduced, CAI Zili introduced that first, the threshold for small-scale VAT taxpayers continues to increase. On the basis of monthly sales of 30,000 yuan to 100,000 yuan in 2019, the threshold for small-scale VAT taxpayers will be further raised to 150,000 yuan this year; Accordingly, the number of small-scale taxpayer households enjoying the exemption policy increased from 33.64 million before the policy adjustment to 38.2 million in 2019, and further increased to 43.65 million in the first three quarters of this year. Accordingly, the amount of tax cuts in 2019 increased from 139.7 billion yuan before the policy adjustment to 228.6 billion yuan, and further increased to 299.5 billion yuan in the first three quarters of this year.

CLIPPER INTERFACE BOARD 603926-101

CLIPPER INTERFACE BOARD 603926-101 Second, the VAT rate for small-scale taxpayers has been significantly reduced. This year, we will continue to implement the policy of reducing the VAT levy rate for small-scale taxpayers introduced in 2020 from 3% to 1%, and the tax burden of taxpayers with monthly sales income of more than 150,000 yuan has been reduced by two-thirds. In the first three quarters of this year, 118.8 billion yuan has been added to the tax cut, benefiting 7.58 million taxpayers.

CLIPPER INTERFACE BOARD 603926-101 Third, the effective income tax rate for small, low-profit enterprises continued to decrease. On the basis of halving the income tax on the part of small low-profit enterprises whose income does not exceed 1 million yuan in 2019, it will be halved again this year, with an effective tax rate of only 2.5%. Accordingly, in 2019, the amount of income tax incentives for small micro-profit enterprises increased from 89.5 billion yuan before the policy adjustment to 208.9 billion yuan, and the tax reduction of 1986.0 billion yuan in the first three quarters of this year has exceeded the tax reduction of the whole of last year, benefiting 5.11 million small micro-profit enterprises. At the same time, the part of small micro-profit enterprises with income of 1 million to 3 million yuan will continue to enjoy the preferential reduction of 10% effective tax rate by half, and the tax reduction of 63.6 billion yuan in the first three quarters of this year will benefit 200,000 small micro-profit enterprises.

CLIPPER INTERFACE BOARD 603926-101 “These preferential tax policies and measures have continued to take root and achieved positive results of ‘one minus two liters’.” CAI Zili introduced, “one reduction” is to reduce the tax burden. In the first three quarters, 70% of small and micro enterprises with income from business activities did not need to pay taxes. On the basis of a year-on-year decline of 19.4% in 2020, the tax paid by small and micro enterprises per 100 yuan of sales revenue fell further by 18.9% in the first three quarters of this year compared with the same period in 2020.

CLIPPER INTERFACE BOARD 603926-101 “Two liters” means that both the number of jobs and the entrepreneurial vitality of the market have increased. In September this year, the number of employees of small and micro enterprises across the country who declared personal income tax increased by 9.9% year-on-year, rising for seven consecutive months since returning to work during the Spring Festival, providing important support for stable employment. By the end of the third quarter, there were 60.76 million small and micro enterprises and individual industrial and commercial households in the tax-related market, an increase of 6.7% over the same period in 2020, an increase of 21.7% over the same period in 2019, and a two-year average increase of 10.3%.

“In the next step, the tax department will further implement and study and improve tax and tax measures to support the development of small and micro enterprises, continue to help small and micro enterprises to grow bigger and stronger, and inject more sustained and strong impetus for the stable and stable economic development.” CAI Zili said.

1 Year Warranty

1 Year Warranty