Up to now, the provincial and local two sessions have been held. Among the top 10 provinces in terms of economic aggregate, seven have announced their 2024 fixed asset investment growth targets, with a minimum of 4 percent and a maximum of about 7 percent. All seven provinces lowered their investment growth targets for 2024 compared with 2023.

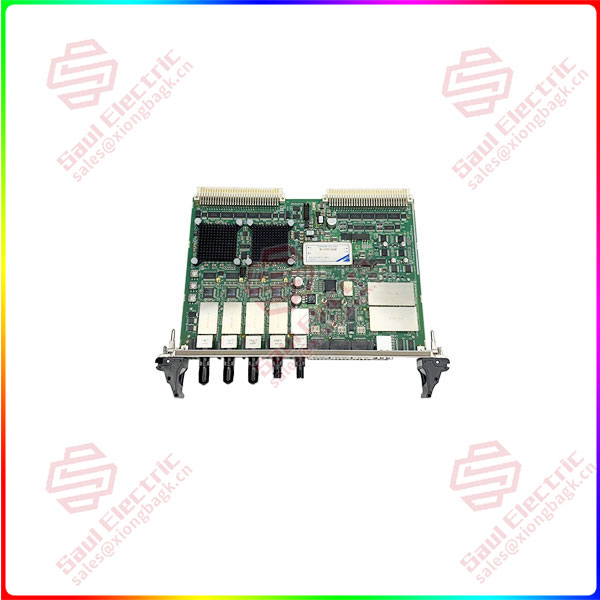

ZMI-4104 Among them, Guangdong province has the largest reduction, from the previous year’s 8% to 4%, a margin of 4 percentage points; This was followed by Henan and Anhui, each down by about 3 percentage points.

For the economic province to reduce the investment growth target, analysts believe that on the one hand and the provincial government generally lower this year’s GDP growth target trend is consistent, on the other hand, also reflects the real estate industry continued to decline on the overall investment drag.

According to Jiemijian News statistics, out of 31 provinces (autonomous regions and municipalities directly under the Central government), 19 have lowered their 2024 economic growth targets, 6 provinces (Shandong, Sichuan, Shaanxi, Jilin, Qinghai and Tibet) are the same as the previous year, and 6 provinces (Jiangsu, Zhejiang, Beijing, Tianjin, Liaoning and Inner Mongolia) have raised their targets.

ZMI-4104 Wang Qing, chief macro analyst of Oriental Jincheng International Credit Rating Co., LTD., told the interface news that the reason why the growth target of various provinces is lowered is mainly due to the fact that the macro economy will further return to normalization this year, the space for residential consumption repair is large, and external demand is expected to pick up slightly, standing at the current point of view, the steady growth of investment demand in 2024 or relatively weakened.

Xu Tianchen, a senior analyst at the Economist Intelligence Unit, pointed out that from 2023, most of the provinces that gave investment growth targets ultimately failed to complete the task, and the performance of real estate is not as expected, which is the main reason for the actual growth rate and the expected deviation. At present, the real estate adjustment period has not yet ended, and it is reasonable for all localities to lower their investment targets in 2024.

ZMI-4104 According to the data disclosed by some provinces, real estate has indeed caused great interference to the growth rate of investment. For example, in 2023, Guangdong’s infrastructure investment and industrial investment increased by 4.2% and 22.2% respectively, but real estate investment fell sharply by 10%, resulting in Guangdong’s fixed asset investment growing by only 2.5% year-on-year, 6.5 percentage points below the expected target. In Hubei Province, the growth rate of infrastructure investment and manufacturing investment in 2023 will be 6.4% and 6.7% respectively, but the investment in real estate development will decline by 3.5%, and the growth rate of overall fixed asset investment will be 5%, 5 percentage points lower than the target.

ZMI-4104

Although the major economic provinces have lowered the fixed asset investment target in 2024, from the government work report released by them, investment is still one of the main tasks of local governments this year, most provinces are increasing industrial investment and building a modern industrial system, and manufacturing investment is expected to take on more tasks to expand domestic demand.

ZMI-4104 For example, Zhejiang Province proposed that this year will focus on scientific and technological innovation, advanced manufacturing, major infrastructure and other key areas, arrange more than 1,000 “thousand trillion” major projects, complete the annual investment of more than 1 trillion yuan. We will make coordinated efforts to attract large numbers of employees and increase capital and production, further expand industrial investment and improve the industrial structure.

Henan Province said that around the construction of a strong manufacturing province, the implementation of high-quality development of the key industrial chain of the manufacturing industry, the expansion of 7 advanced manufacturing clusters of 28 key industrial chains, the downward sorting and extension of N specialized new segments, beads into chains, chain clusters, and strive to break through 7 trillion yuan in industrial scale by 2025.

ZMI-4104 Anhui Province proposed to implement a series of activities of “Investing in Anhui” and carry out the “leading” plan for investment in advanced manufacturing industry, and the investment in manufacturing industry increased by more than 10%. We will increase investment in consumer products such as new energy vehicles and smart terminal equipment.

From the national point of view, analysts believe that with the support of the central financial force, the growth rate of fixed asset investment in 2024 May increase compared with 2023. In 2023, China’s fixed asset investment increased by 3.0% over the previous year, and the growth rate was 2.1 percentage points lower than that in 2022.

ZMI-4104 Xu Tianchen expects the national investment growth rate to be about 4.2% in 2024. “In the real estate adjustment continues, local debt investment is restricted in the background, the central investment will become the main starting point, with the support of the central finance, major project investment will continue to promote, driving infrastructure investment to maintain a certain intensity of growth, at the same time, industrial upgrading logic of manufacturing investment will also be maintained at a moderate speed level.” ‘he said.

Mr. Wang expects investment growth of about 4.5 percent this year. He said that the target fiscal deficit ratio in 2024 is expected to be increased, the amount of new special bonds will reach about 4 trillion yuan, and 500 billion yuan of the 1 trillion yuan of national bonds issued in the fourth quarter of last year will be put into use in 2024, and infrastructure investment will maintain rapid growth. With the support of relevant policies, the internal momentum of manufacturing investment is also expected to increase.

Delu Capital macro research head Wang Yunjin also expects this year’s investment growth rate of about 4.5%. Among them, infrastructure investment is expected to grow rapidly under the support of government special debt funds in 2023; At the same time, benefiting from industrial policy support, manufacturing investment will receive greater support from social capital and will maintain rapid growth.

1 Year Warranty

1 Year Warranty