How to find a balance between profitability and growth?

In the words of Nadella’s book Refresh, every person, every organization, and every society, at a certain point, should click refresh – re-energize, re-energize, re-organize and rethink the meaning of their existence.

If the parent company does not want to be encumbered by new business itself, it does not want to be encumbered by new business itself. Spin-off and independent listing have become the fastest and most effective way.

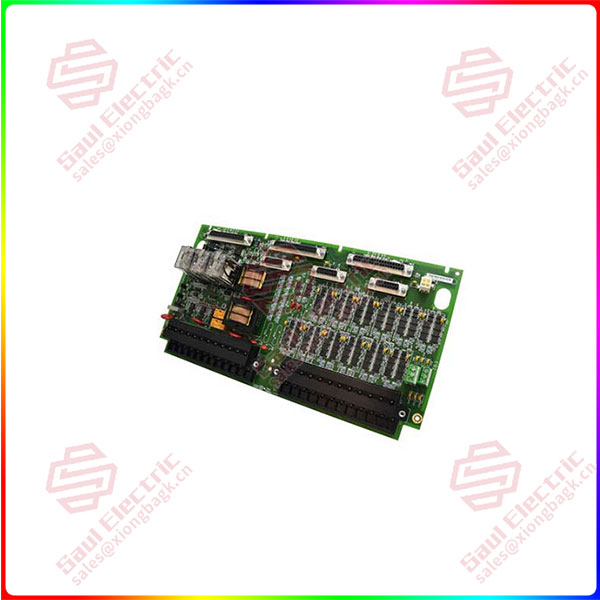

IS200EROCH1A B-side: The lure of “more +”

More money, a better story

In the parent company, through the separation and stripping of the industrial interconnection department to achieve self-reduction, the cost center can be stripped, and more beautiful financial data can be obtained.

If the company can be listed after the spin-off, the parent company can not only obtain excess investment benefits through holding shares, but also improve the market valuation of both the parent company and the new company.

In the industrial interconnection enterprises, in the early stage of the IS200EROCH1A brutal growth of the industry, the business needs more resources and financial support, whether it is split or independent listing, it can directly docking with the capital market, and the financing channels are greatly expanded.

In fact, the industrial Internet companies that ran out of the large manufacturing field are not idle people.

In the industrial Internet market dominated by industrial knowledge, they have rich industrial scene accumulation, industrial mechanism model precipitation, strong industry resources and stable and solid work style from the day of birth.

With resources and industry barriers, it is easier to obtain the transfusion of capital markets after a break-up or independence.

IS200EROCH1A

So we can see that in 2021, Halkaos COSMOPlat announced the completion of more than 1 billion yuan of B round financing, and its valuation doubled to exceed 15 billion yuan.

In 2017, the first round of financing of Root Internet received hundreds of millions of yuan, after which there were funds for three consecutive years, the financing amount from 100 million yuan to 500 million to 800 million yuan, on November 30, 2021, Root Internet was listed in the “2021 Global Unicorn List” with a valuation of 6.5 billion yuan.

IS200EROCH1A INDICS, obtained 2.632 billion yuan of strategic investment in March 2021, and was valued at 10 billion yuan after investment.

Xugong Han Yun from 10 million investment to now several times the value, is currently in the listing counseling period.

The industrial Internet platform Gechuang East Intelligence incubated by TCL also won A round of financing of 100 million yuan from Yunfeng Fund.

Wu Jun expressed a view in “Top of the Wave” : a “professional” company will definitely perform better in a specific field than an all-around company.

From the perspective of capital, in a large enough enterprise, synergies may not be obvious, and capital may not need too many diversified businesses for startups, and they are more inclined to invest in different enterprises to achieve risk diversification.

He Dongdong, co-founder and CEO of Root Internet, also told Leifeng IS200EROCH1A Network that a very important criterion for judging platform-type industrial Internet companies is whether the platform operates independently and whether the shareholders of the company have top VC.

“Finding investors with the same business philosophy and investment philosophy can lead the invested companies to have a more long-term vision.” He Dongdong said that behind the successful enterprises often have the shadow of first-class VC funds, “really understand the industry, long-term venture capital, will really invest in, willing to use money to burn research and development, earn the future.”

Industrial Internet startups, under the inevitable trend of industry 4.0, have a huge imagination space, with strong capital backing, they can as far as possible to achieve the industrial digitalization story in their hearts.

From being at best a large department in the manufacturing enterprise system, solving the problems of the enterprise itself, to the vast market that stands after independence,

It is equivalent to going from a towering tree (within one’s own system) to a forest (the entire market).

Just as Alipay, after its independence from Taobao, has grown from a payment tool to a huge IS200EROCH1A Internet amount giant, the industrial Internet enterprises after separation and independence also have the potential to grow into the industry 4.0 wave.

Lighter movement, more power

The reason for the separation is the result of the digitalization impact on traditional industries.

Although it is a long-term route, the field of technology and digitalization is changing rapidly, and it is important to occupy a place at the starting line, and a wrong step may lose the opportunity. Rapid growth, centralized output, imminent.

In the new company, cutting off the shackles of light or can speed up development.

Jump out of the system, develop independently, no longer responsible for the short-term losses of the parent company, and there are fewer unnecessary constraints and concerns.

At the same time, the decision-making mechanism and management mechanism of the new company have more independent decision-making power, and the information is transmitted more quickly. Under the flexible system, the needs of business iteration, expansion speed and talent introduction are met to a greater extent.

For example, when the root Internet was established in 2016, the original Sany team was only more than ten people, and nearly 70 people were recruited from the outside in the first year.

1 Year Warranty

1 Year Warranty