Ac servo, low voltage inverter, HMI and other product lines

Five consecutive quarters of negative year-on-year growth

In the first quarter of 2024, the overall industrial control industry faced challenges, especially in the AC servo, low voltage frequency converter, and HMI (human machine interface) key product lines. The five consecutive quarters of negative year-on-year growth reflect the overall decline in market demand, with varying degrees of impact in different industries and markets.

Low-voltage inverter: Integrated OEM and project-based market, in addition to individual industries such as textiles, HVAC, rubber, municipal, chemical industries, the vast majority of industries in the first quarter are in a state of decline, machine tools – woodworking decline of nearly 30%. The sluggish market environment has led to a decline in the overall performance of low-voltage frequency converters.

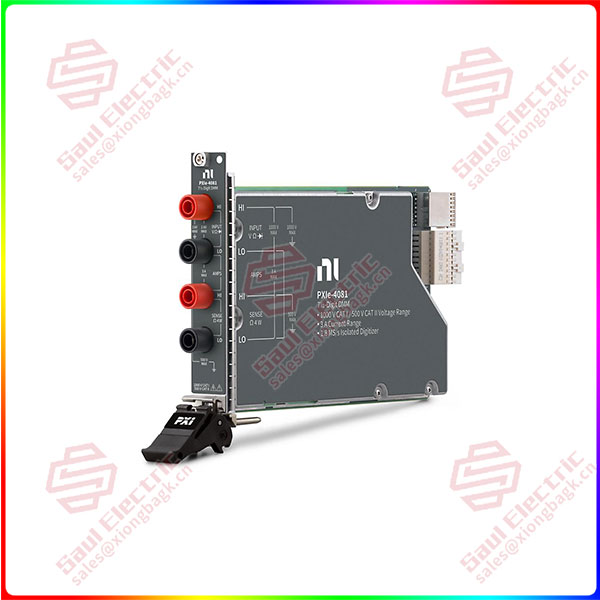

PXIE-4081 Ac servo: 2024Q1, the general servo market showed a slight downward trend. Multi-industry investment enthusiasm has declined, and related demand has declined significantly. Only 3C related industries demand has picked up. The supply chain performance of most manufacturers is stable, and foreign manufacturers are actively carrying out localization layout.

HMI: New energy-related industries declined significantly due to the slowdown in terminal investment; Sales of manufacturers in traditional industries were basically unchanged from the first quarter of 2023, with a slight increase.

PLC: In the first quarter, PLC downstream demand was weak, and manufacturers’ sales declined. New energy-related industries due to the slowdown in terminal investment, the decline is obvious; The sales of manufacturers in traditional industries were basically unchanged from the first quarter of 2023, with a slight increase. Most manufacturers have returned to normal production and supply capacity. The inventory backlog level of dealers of European and American manufacturers is still high, resulting in more spot on the market, the situation of oversupply, and the enthusiasm of dealers of European and American manufacturers to order is also relatively low.

PXIE-4081

In the face of continued market challenges and weak downstream demand, the government has gradually implemented the old for new policy, aimed at stimulating market demand and boosting the development of the industrial control industry. The implementation of this policy is likely to bring about a recovery in market demand in the coming quarters, which will have a positive impact on the entire industry.

04 Ten listed Chinese automation companies announce financial results

The head of foreign enterprises downsizing, suffered a double attack

PXIE-4081 The content of the annual report often reflects the business situation, financial condition and development trend of the enterprise in the past year. “Challenges and opportunities coexist” is a significant feature of the current development of China’s automation industry. MIR has compiled the main financial information of 10 listed Chinese automation companies in 2023.

The main financial information of 10 listed Chinese automation manufacturers in 2023

According to the analysis of the annual operating income of ten listed companies in 2023, the revenue of Huichuan Technology exceeds 10 billion yuan, the revenue of Zhongcong Technology, Yingwei Teng, Xinjie Electric, Leisai Intelligent, Hekang New Energy, Wei Chuang Electric and Hechuan Technology is in the range of 1 billion to 10 billion yuan, and the revenue of Sine Electric and Buke shares is in the range of 300 million to 1 billion yuan. Overall, the revenue of 10 enterprises has achieved positive growth year-on-year.

In terms of net profit, five companies achieved positive year-on-year growth, of which Huichuan Technology, Zhongkong Technology, Weichuang Electric and Inwitten performed particularly well. In addition, the net profit of five enterprises has declined, of which Hekang New Energy has the most significant decline, down 958.43%.

Recently, the first quarter report of China’s automation listed enterprises in 2024 has also been released. How will the performance of these companies change compared to 2023? Let’s take a look:

The main financial information of 10 Chinese listed automation manufacturers in 2024 Q1

In the first quarter report of 2024, there were 7 enterprises with positive revenue growth and 3 enterprises with negative revenue growth. In terms of net profit, 6 enterprises achieved positive growth year-on-year, and 4 enterprises declined; 1 enterprise presents the situation of increasing income without increasing profit. Most of the enterprises with stable performance in 2023 annual report will still play stable in the first quarter of 2024.

1 Year Warranty

1 Year Warranty