Industrial machine market size and output value

Global market size and output value

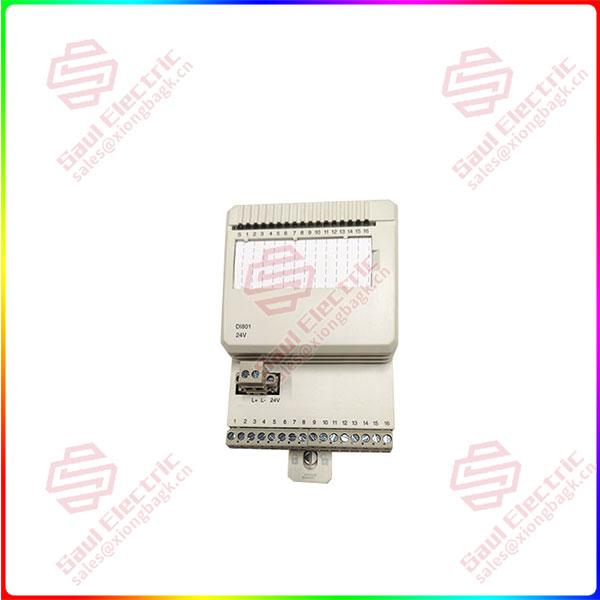

DI801 According to the official data released by the German Machine Tool Manufacturers Association (VDW), from the perspective of supply, the total output value of the global machine tool industry in 2022 is about 80.3 billion euros, and China ranks first in the world with a total output value of 25.7 billion euros, accounting for 32% of the global market, followed by Japan and Germany, with an output value of 9.9 billion euros and 9.7 billion euros, respectively. In the global market share of 12%.

From the perspective of demand, the consumption of the global machine tool industry in 2022 is 80.8 billion euros, China ranks first in the world with a scale of 26 billion euros, also accounting for 32% of the global market, followed by the United States and Germany, with consumption of 9.7 billion euros and 5.2 billion euros, respectively, accounting for 12% and 7% of the global demand market. From the perspective of both supply and demand, the total size of the top three countries accounts for more than 50% of the global market size.

Chinese market size and output value

Since China’s accession to the WTO, the rapid growth of the machine tool industry, according to the data released by the China Machine Tool Industry Association, 2001-2011 China’s metal processing machine tool production and consumption increased from $3.97 billion to a high of $39.09 billion, a compound annual growth rate of 25.70%. Since then, with the upgrading of the domestic economic structure and supply-side reform to reduce production capacity, domestic machine tool consumption has experienced a 10-year decline. In 2020, affected by the epidemic, the consumption of metal processing machine tools reached a low of $21.3 billion since 2011.

DI801

According to the China Machine Tool Industry Association estimates, in 2022, China’s metal processing machine tool production of 27.11 billion US dollars, an increase of 5.1%, of which metal cutting machine tool production of 17.22 billion US dollars, an increase of 3.3%; In 2022, the consumption of metal processing machine tools in China was 27.41 billion US dollars, down 1.9% year-on-year, of which, the consumption of metal cutting machine tools was 18.44 billion US dollars, down 4.3% year-on-year.

According to the characteristics of the previous “3-year update” cycle of machine tool equipment, the domestic industrial machine market will decline in 2023.

Industrial machine industry competition pattern

DI801 Overall competition pattern of the industry

The world’s leading high-end CNC machine tool enterprises are mainly concentrated in Germany, Japan and the United States. Overseas machine tool enterprises have more product categories, and have developed earlier, and have rich technology accumulation, whether it is in processing performance, processing accuracy, or the integrity of the industrial chain, compared with domestic manufacturers have obvious advantages.

Domestic CNC machine tool brand awareness, product technology level than the international leading machine tool manufacturers still have a certain gap, resulting in domestic CNC machine tool manufacturers in the low-end field of competition is more intense. In recent years, some private enterprises in China have gradually made some progress in the low-end field, and some excellent private enterprises have entered the second echelon of the industry, and continue to narrow the gap with foreign manufacturers, becoming the backbone of domestic machine tools. In the field of high-end CNC machine tools, there is a large space for localized development.

1 Year Warranty

1 Year Warranty